Gann Square of Nine is also known as Gann Sq 9 or Gann Pyramid, is one of the most important tools in investment of your money at online trading system in anywhere in the world. After getting mastering it is very useful for financial analysis trends.

Gann Square of Nine is also known as Gann Sq 9 or Gann Pyramid, is one of the most important tools in investment of your money at online trading system in anywhere in the world. After getting mastering it is very useful for financial analysis trends.

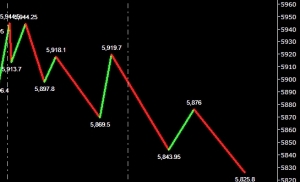

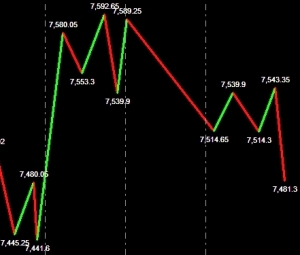

The Gann square of nice is generally used to confirm the significance of high & low in stock markets also in other types of investments. When you buy a particular stock & how much to pay others. Really the Gann Square of Nine makes just not only possible, but also a reality that has also worked for more investors over the past century over the past.

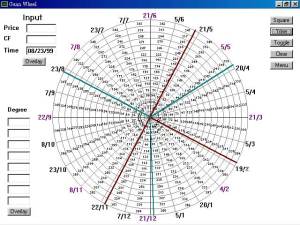

Really Gann Square of Nine should never be used to only choose tops & bottoms when selecting the stocks, but it can be managed to provide additional information to confirm how significant a recent high or low indication in the market trends that was when a break in a trend occurs. Gann Square of Nine (Gann Sq 9) is similar in shape & idea to a wheel or circle, and is generally also referred to as the Gann Wheel.

It starts with the number one in the center & radius out to the first square of 9. It begins from 2 or 1 to left of the corner and then it spirals clockwise to the direction of number 9 in order to form its 1st rotation square of nine. This shifts one unit to the left of nice and the next rotation begins at 10. Further it will continue its spirals to the number 20 and so on.

The Gann Square of Nine is a time and price calculator that figure root of numbers, for both odd & even also their mid points very well. It is also for seek time & price alignments from particular starting point levels i.e. high or low point in a given market.

If you are looking at the numbers that show on the grid that run down to bottom left corner on Gann Square of Nine, you will also find them to be the square root of odd numbers. For example of this would be like 5×5 = 25. If on the other hand, you can look at the numbers that run up well to the top right corner on Gann Square of Nine, you will choose they are square root of even numbers i.e. 4×4 = 16.

Numbers that run down to the bottom right corner will appear you the midpoint between the squares of odd & even numbers. Let’s need to use numbers 25 and 16 mentioned above to illustrate this. At here, the number 21 would represent their midpoint due to it falls exactly between them.

The Gann Square 9 is an arrangement of numbers with a particular order & a used in a number of ways. Further after review of Gann Square of Nine will see you how it will work and illustrate its usefulness in determining market trends highs and lows.

Art of Trading has traded futures & options for one of the largest cash Trading firms in the India. Also currently owns and runs at http://www.artoftrading.co.in